Introduction

Financial Literacy for Teachers is increasingly recognized as a critical life skill, the role of teachers in imparting this knowledge to students cannot be overstated. Financial literacy encompasses the ability to understand and effectively use various financial skills, including personal financial management, budgeting, and investing. For teachers, developing financial literacy is not only essential for their personal financial well-being but also crucial in preparing students to navigate the complexities of the financial world. This article explores the importance of financial literacy for teachers, the benefits it brings, the challenges they face, and practical steps to enhance financial literacy among educators.

The Importance of Financial Literacy for Teachers

Financial literacy for teachers is essential for several reasons:

- Personal Financial Management: Teachers, like everyone else, need to manage their personal finances effectively. Understanding how to budget, save, invest, and plan for retirement ensures financial stability and reduces stress associated with financial uncertainty.

- Role Models for Students: Teachers are role models, and their attitudes towards money can influence their students. By demonstrating sound financial practices, teachers can inspire students to adopt similar habits.

- Incorporating Financial Education: It can seamlessly incorporate financial education into their curriculum, regardless of the subject they teach. This integration helps students develop financial skills from an early age.

- Empowering the Next Generation: Financially literate teachers are better equipped to teach students about money management, preparing them to become financially responsible adults. This education is crucial in a world where financial decisions can significantly impact one’s quality of life.

Benefits of Financial Literacy for Teachers

Enhancing financial literacy among teachers yields numerous benefits:

- Improved Personal Financial Health: This can make informed decisions about spending, saving, and investing. This knowledge leads to better financial health, reduced debt, and increased savings.

- Enhanced Job Performance: Financially stable teachers are less likely to be stressed about money, which can improve their focus and effectiveness in the classroom. This stability can lead to better job performance and job satisfaction.

- Greater Confidence in Teaching Financial Concepts: Teachers with a solid understanding of financial principles feel more confident teaching these concepts to their students. This confidence ensures that students receive accurate and practical financial education.

- Positive Community Impact: Financially literate teachers contribute to the overall financial literacy of the community. As they share their knowledge with students and colleagues, the positive impact extends beyond the classroom.

Challenges in Promoting Financial Literacy Among Teachers

Despite its importance, promoting it presents several challenges:

- Lack of Training: Many teachers have not received formal training in financial literacy. This lack of training can make it difficult for them to feel confident teaching financial concepts.

- Time Constraints: Teachers often face heavy workloads and time constraints, leaving little room for professional development in financial literacy. Finding the time to learn and incorporate financial education can be challenging.

- Curriculum Limitations: In some education systems, financial literacy is not a mandated part of the curriculum. This absence can make it difficult for teachers to prioritize financial education in their teaching.

- Personal Financial Challenges: Teachers, like many professionals, may face their own financial challenges, such as student loan debt or inadequate salaries. These challenges can make it difficult for them to focus on financial literacy.

Practical Steps to Enhance Financial Literacy Among Teachers

Improving it requires a multifaceted approach involving professional development, curriculum integration, and community support.

- Professional Development Programs: Schools and educational institutions should offer professional development programs focused on financial literacy. These programs can provide teachers with the knowledge and resources they need to manage their finances and teach financial concepts.

- Integration into Teacher Education: Financial literacy should be integrated into teacher education programs. By including financial education as part of the curriculum for aspiring teachers, institutions can ensure that future educators well-prepared to teach these concepts.

- Collaborative Learning Opportunities: Encouraging teachers to participate in collaborative learning opportunities, such as workshops, seminars, and online courses, can help them enhance their financial literacy. These platforms allow teachers to share knowledge and resources with their peers.

- Incorporating Financial Literacy into the Curriculum: Teachers can incorporate financial literacy into their existing curriculum, regardless of the subject they teach. For example, math teachers can include lessons on budgeting and interest rates, while social studies teachers can discuss the economic impact of financial decisions.

- Access to Resources and Tools: Providing teachers with access to high-quality financial literacy resources and tools can support their learning and teaching efforts. These resources can include lesson plans, interactive tools, and real-world case studies.

- Partnerships with Financial Institutions: Schools can form partnerships with financial institutions to provide financial literacy training for teachers. These institutions can offer expertise, resources, and support to enhance teachers’ financial knowledge.

- Creating a Supportive Environment: Schools should create a supportive environment that encourages ongoing financial education for teachers. This support can include dedicated time for professional development, recognition of teachers’ efforts in financial education, and a culture that values financial literacy.

Financial Literacy Curriculum for Teachers

To effectively enhance it, as comprehensive curriculum should cover the following key topics:

- Budgeting and Personal Finance Management: Teachers should learn how to create and manage budgets, track expenses, and develop financial plans. This knowledge is foundational for both personal and professional financial stability.

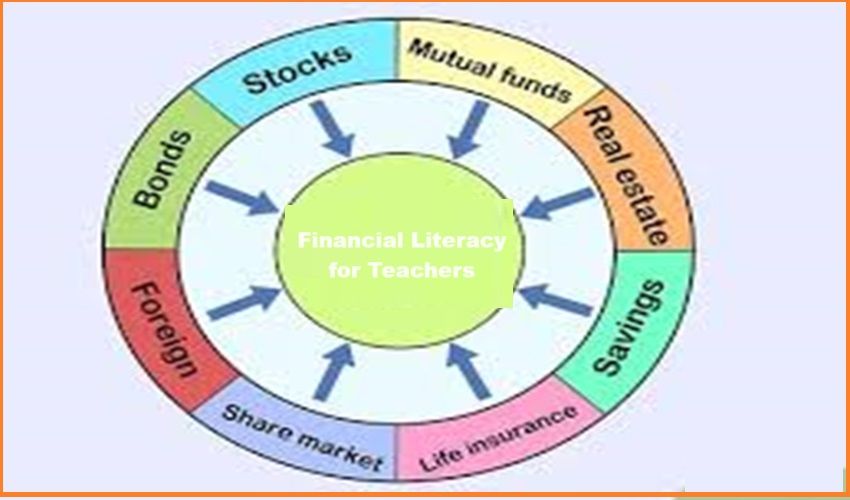

- Saving and Investing: Understanding different saving and investment options, including retirement accounts, stocks, bonds, and mutual funds, is crucial. Teachers should learn how to build and diversify their investment portfolios to achieve long-term financial goals.

- Debt Management: Teachers should equipped with strategies for managing and reducing debt, including student loans, credit cards, and mortgages. Understanding interest rates, repayment plans, and debt consolidation options is essential.

- Insurance and Risk Management: Knowledge of various types of insurance, such as health, life, and property insurance, helps teachers protect their financial well-being. Risk management strategies, including emergency funds, should also be covered.

- Retirement Planning: Teachers should understand the importance of retirement planning and the different options available, such as pension plans, 401(k)s, and IRAs. Learning how to estimate retirement needs and create a retirement plan is critical.

- Tax Planning: Basic knowledge of tax planning, including how to file taxes, understand tax brackets, and take advantage of deductions and credits, is valuable for financial literacy. Teachers should learn how to plan for taxes and maximize their after-tax income.

- Financial Goal Setting: Teachers should learn how to set and achieve financial goals, whether short-term (e.g., saving for a vacation) or long-term (e.g., buying a home). Goal setting helps teachers stay focused and motivated in their financial journey.

Conclusion

Financial literacy is a vital skill for teachers, empowering them to manage their finances effectively and impart crucial financial knowledge to their students. By enhancing financial literacy among teachers, we can create a ripple effect that benefits not only educators and their families but also the students they teach and the broader community. Addressing the challenges and providing comprehensive training and resources are essential steps in fostering a financially literate society. As teachers become more financially savvy, they can play a pivotal role in shaping a future generation that well-equipped to make informed financial decisions and achieve financial success.

wfmzht

I¦ve recently started a website, the information you provide on this website has helped me greatly. Thanks for all of your time & work.

he0ln4

Temukan peluang menang besar di Shark Bounty : Slot Online Gacor yang Menjanjikan

Looking for the best alarm clock radio with CD player and modern features? This HD tabletop radio combines vintage charm with today’s technology. Features include a CD player, AM/FM radio, dual alarm settings, and a USB port for device charging. Perfect for bedside tables or desktops, the sleek design doesn’t sacrifice performance. Whether you’re waking up to your favorite radio station, a beloved CD, or a gentle buzzer, this unit is your all-in-one morning companion. The CD clock radio is back—and better than ever.

Do you have a spam problem on this website; I also am a blogger, and I was wondering your situation; many of us have created some nice methods and we are looking to swap methods with other folks, why not shoot me an email if interested.

Hi, Neat post. There is a problem with your web site in internet explorer, would test this… IE still is the market leader and a large portion of people will miss your great writing due to this problem.

Hey there, You’ve done a great job. I will certainly digg it and personally recommend to my friends. I am confident they will be benefited from this site.

hello!,I really like your writing so so much! proportion we be in contact extra approximately your article on AOL? I need an expert in this house to unravel my problem. Maybe that is you! Taking a look forward to peer you.

Hi! I’m at work browsing your blog from my new iphone 3gs! Just wanted to say I love reading through your blog and look forward to all your posts! Carry on the great work!

Appreciate it for this terrific post, I am glad I observed this web site on yahoo.

I am not really great with English but I find this real easy to interpret.

Together with the whole thing which appears to be developing throughout this subject material, a significant percentage of viewpoints are actually rather refreshing. However, I am sorry, because I can not subscribe to your whole idea, all be it radical none the less. It seems to everyone that your comments are generally not entirely rationalized and in reality you are yourself not fully confident of your assertion. In any event I did enjoy reading it.

What’s Going down i’m new to this, I stumbled upon this I’ve found It positively helpful and it has aided me out loads. I am hoping to contribute & help different customers like its aided me. Great job.

Thanks for taking the time to break this down step-by-step.

I enjoyed your take on this subject. Keep writing!

I appreciate how genuine your writing feels. Thanks for sharing.

I wasn’t expecting to learn so much from this post!

**sugarmute**

sugarmute is a science-guided nutritional supplement created to help maintain balanced blood sugar while supporting steady energy and mental clarity.

**gl pro**

gl pro is a natural dietary supplement designed to promote balanced blood sugar levels and curb sugar cravings.

**prostadine**

prostadine is a next-generation prostate support formula designed to help maintain, restore, and enhance optimal male prostate performance.

**nitric boost**

nitric boost is a dietary formula crafted to enhance vitality and promote overall well-being.

**mitolyn**

mitolyn a nature-inspired supplement crafted to elevate metabolic activity and support sustainable weight management.

**breathe**

breathe is a plant-powered tincture crafted to promote lung performance and enhance your breathing quality.

**potentstream**

potentstream is engineered to promote prostate well-being by counteracting the residue that can build up from hard-water minerals within the urinary tract.

**hepatoburn**

hepatoburn is a potent, plant-based formula created to promote optimal liver performance and naturally stimulate fat-burning mechanisms.

**sleep lean**

sleeplean is a US-trusted, naturally focused nighttime support formula that helps your body burn fat while you rest.

**memorylift**

memorylift is an innovative dietary formula designed to naturally nurture brain wellness and sharpen cognitive performance.

Very interesting information!Perfect just what I was searching for! “Peace, commerce and honest friendship with all nations entangling alliances with none.” by Thomas Jefferson.

I have been surfing on-line more than three hours nowadays, but I by no means found any attention-grabbing article like yours. It’s pretty worth sufficient for me. Personally, if all webmasters and bloggers made excellent content as you probably did, the net might be much more useful than ever before. “Wherever they burn books, they will also, in the end, burn people.” by Heinrich Heine.

Smart take

I absolutely love your blog and find many of your post’s to be exactly what I’m looking for. can you offer guest writers to write content available for you? I wouldn’t mind composing a post or elaborating on a lot of the subjects you write regarding here. Again, awesome site!

You actually make it seem really easy along with your presentation however I to find this topic to be really one thing that I believe I’d by no means understand. It kind of feels too complicated and very vast for me. I’m taking a look ahead in your subsequent submit, I¦ll attempt to get the grasp of it!